Challan

What is a Challan?

A challan is a formal document that serves as a receipt or proof of payment for various transactions. It is used in many official and legal contexts, such as government fees, fines, or banking transactions. The challan is typically issued by a government agency, bank, or other official body and is often required for record-keeping or further processing of services.

Purpose of a Challan

- To acknowledge the receipt of payment.

- To serve as proof of payment for legal or official processes.

- To ensure transparency and accountability in financial transactions.

- To track payments made by individuals or organizations.

Structure of a Challan

A challan generally includes the following information:

-

Challan Number: A unique identifier for each challan.

-

Date: The date of issuance.

-

Payer's Details: Name, address, and contact information of the person or entity making the payment.

-

Receiver's Details: Name and details of the entity receiving the payment.

-

Amount: The total amount to be paid.

-

Purpose of Payment: Description of why the payment is being made (e.g., tax, fine, fee).

-

Payment Method: Details on how the payment was made (cash, cheque, online transfer).

-

Signature and Stamp: Auhorized signature and stamp of the issuing authority.\

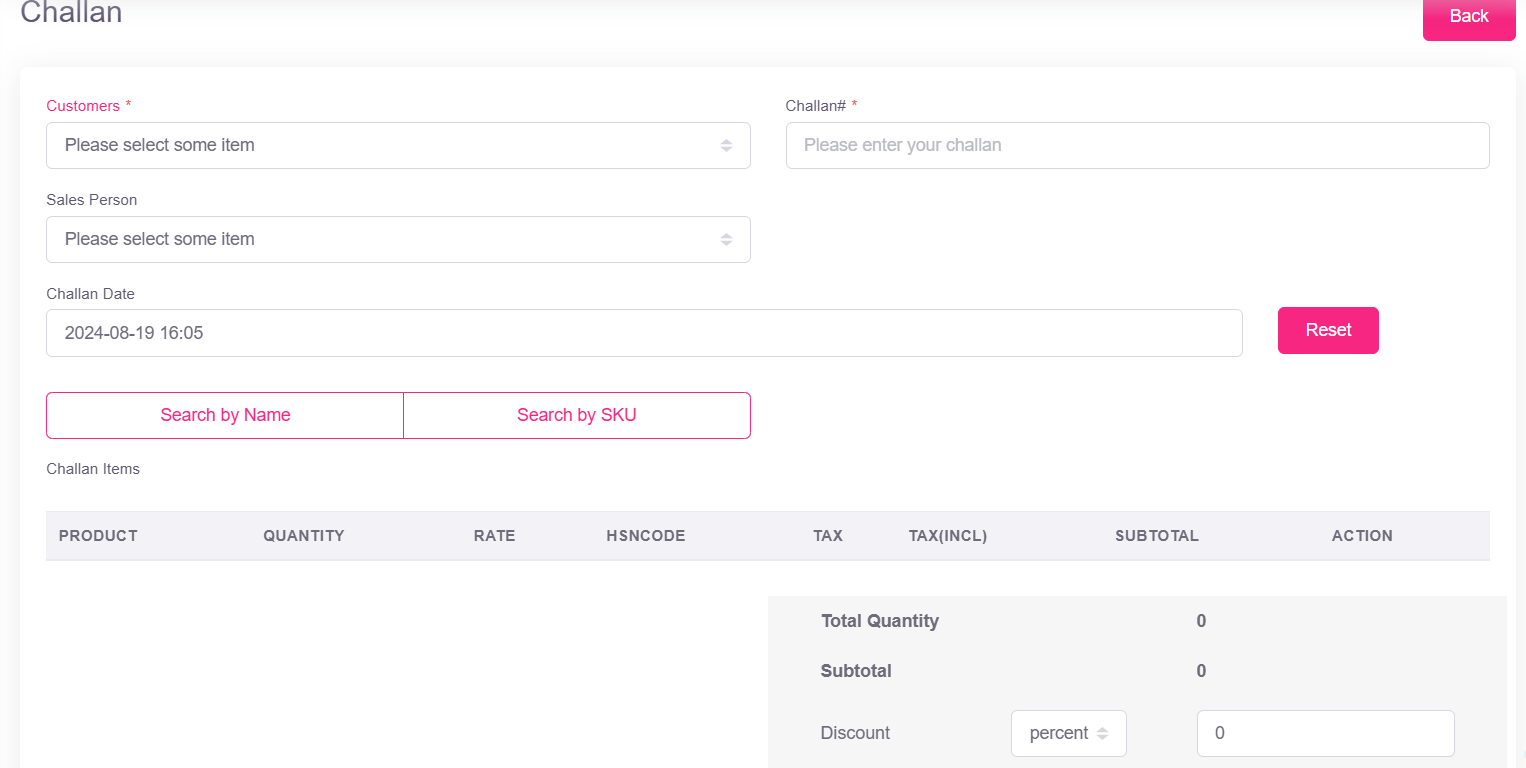

How to Generate a Challan

Challan Generation:

- Fill in the details in the prescribed challan form.

- Ensure all mandatory fields are correctly filled out.

- Submit the form to the concerned authority, along with the payment.

Payment Submission

- Submit the challan along with the payment to the concerned authority (e.g., bank, traffic department).

- Ensure that the challan is duly stamped and signed by the official receiving the payment.

Record Keeping

- Keep a copy of the challan for your records.

- Use the challan as proof of payment in any future correspondence or disputes.

Verification

- The recipient authority may use the challan to verify that the payment has been made.

- In the case of an e-challan, the verification can often be done online using the challan number.